As the software sector continues to evolve at a rapid pace, Software as a Service (SaaS) solution powered by Artificial Intelligence (AI) have become a key factor in investment and acquisition strategies.

In 2025, this trend is clearly visible in the interests of strategic investors, corporations, and private equity funds, all seeking to enhance long-term value creation and competitiveness by integrating AI capabilities into their product portfolios.

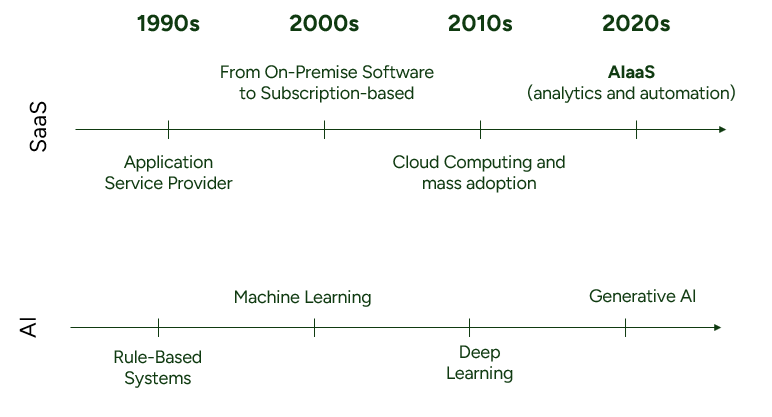

The Rise of Artificial Intelligence in Software Platforms

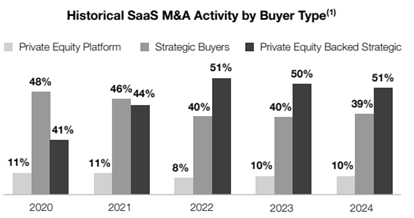

The global software and data solutions market is undergoing a profound transformation. The integration of AI into cloud-based services has quickly become an essential part of corporate demand, driven by the need to differentiate products, boost customer engagement, and improve operational efficiency. As a result, investor interest in AI-enabled SaaS companies has grown significantly, reflected in M&A activity over the past 18 months.

Large corporations are aiming to enhance their product portfolios, while private equity funds are pursuing scalable, data-driven business models.

A key trend is the evolution of the SaaS licensing pricing model. Likewise, providers are monetizing AI functionalities within the SaaS platform such as:

- Process automation

- Real-time analytics

- Intelligent recommendations

In many cases, acquiring these capabilities through inorganic growth is more efficient than building them internally, particularly given the actual issue with the of skilled talent and rising competition in the sector.

Shifts in Corporate Strategy

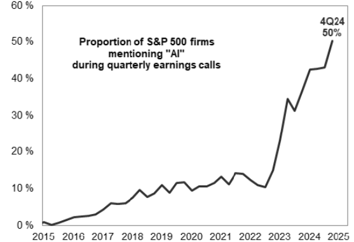

AI integration has become a productivity driver across multiple industries. Companies are achieving tangible results by deploying AI in areas such as supply chain management, marketing automation, financial forecasting, and customer service.

Artificial Intelligence as a Service (AIaaS) is gaining traction, offering access to advanced capabilities without the need for in-house experts. These platforms adapt functionalities to different customer profiles.

Source: Goldman Sachs Global Investment Research

At the same time, market volatility has made valuation adjustments in the SaaS segment more attractive, generating investment opportunities. Several software companies experienced valuation corrections in 2023 and 2024, positioning them as acquisition targets. Global private equity investment in AI increased by 18.7% in 2024 compared to the previous year, reflecting investors’ interest in the potential of AIaaS.

Relevant M&A Cases

Some recent examples that illustrate the trend of combining SaaS and AI in strategic investments:

Microsoft and OpenAI: Microsoft has made several significant investments in OpenAI and continues negotiations to acquire additional ownership. Its goal is to secure access to critical AI technologies and strengthen its leadership in AI-powered enterprise solutions.

Lovable: The startup specializing in “vibe coding” raised $200M in its latest funding round, reaching a $1.8B valuation. Founded in Sweden just two years ago, Lovable already counts major investors such as Revolut and Klarna.

ElevenLabs: The voice-cloning AI company raised $180M at a $3.3B valuation in its Series C round.

These cases exemplify how investors now tend to invest in companies incorporating generative AI, especially following the famous case of OpenAI’s ChatGPT, which successfully monetized AI-driven products.

M&A Comparison: Traditional SaaS vs. AI Companies

While SaaS and AI firms share a software- and subscription-based model, acquisition drivers often differ:

Traditional SaaS

- Financial stability: focus on ARR, customer retention, and consistent margins.

- Strategic synergies: cost reduction and reduced go-to-market risks through consolidated operations.

- Lower regulatory risk: more limited legal exposure compared to AI businesses.

- Predictable scalability: solid growth in established platforms.

AI Companies

- Talent and IP: acquisition of algorithms, datasets, and specialized technical teams.

- Innovation over profitability: emphasis on product differentiation rather than immediate revenues.

- Regulation and ethics: need to align with emerging regulatory frameworks, especially in the EU.

- Strategic transformation: ability to redefine core offerings and build sustainable competitive advantages.

Challenges and Opportunities in 2025

- SaaS: saturated market, churn risk, and less adaptability.

- AI: revenues growing at a rate ≈35% higher than SaaS, but facing challenges in scalability, infrastructure costs, and monetization models.

In both cases, competition is fierce: well-funded startups and major tech players are driving up acquisition multiples and execution risks.

Implications for M&A

Mergers and acquisitions remain an effective mechanism to capture strategic capabilities, accelerate time-to-market, and consolidate market positions.

SaaS acquisitions deliver operational excellence, recurring revenue, and scalability.

AI acquisitions provide transformational value and access to disruptive technologies.

The most attractive opportunities combine both approaches, software platforms with strong financial fundamentals enhanced by AI, creating sustainable value by aligning long-term innovation with short-term performance.

Convergence of SaaS and AI

The line between SaaS and AI is blurring. AI is no longer an add-on but a central strategic driver, and due diligence processes now include assessments of maturity, governance, and adaptability. For both financial and corporate investors, SaaS–AI convergence represents an opportunity to redefine enterprise value in the short and long term.